Condo Insurance in and around Sturgis

Unlock great condo insurance in Sturgis

Insure your condo with State Farm today

Home Is Where Your Heart Is

Life happens.. Whether damage from hail, fire, or other causes, State Farm has reliable options to help you protect your condominium and personal property inside against unanticipated circumstances.

Unlock great condo insurance in Sturgis

Insure your condo with State Farm today

Condo Coverage Options To Fit Your Needs

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance covers more than your condo. It protects both your condo and your valuable possessions. If your condo is affected by a tornado or vandalism, you could have damage to some of your possessions in addition to damage to the structure itself. If your belongings are not insured, you might not be able to replace your valuables. Some of your belongings can be replaced if they damaged even beyond the walls of your condo. If your car is stolen with your computer inside it, a condo insurance policy could cover the cost.

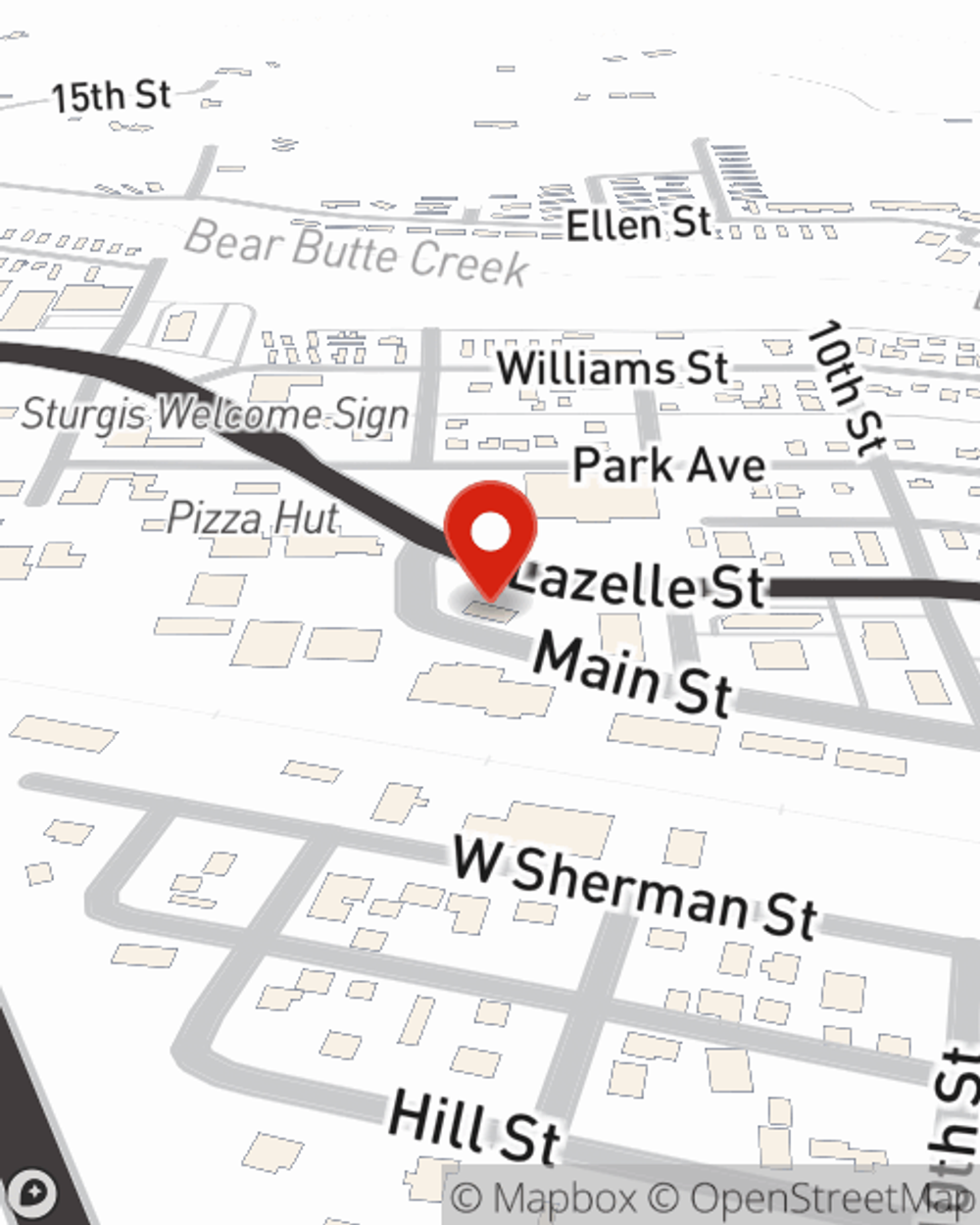

Reach out to State Farm Agent Eric Fowler today to find out how one of the top providers of condo unitowners insurance can help protect your condo here in Sturgis, SD.

Have More Questions About Condo Unitowners Insurance?

Call Eric at (605) 347-3931 or visit our FAQ page.

Simple Insights®

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Eric Fowler

State Farm® Insurance AgentSimple Insights®

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.